Product Perlindungan Tenang PTV 3.0:

FREQUENTLY ASK QUESTIONS (FAQ) PERLINDUNGAN TENANG VOUCHER 3.0 PROGRAMME

-

The Perlindungan Tenang Voucher 3.0 Programme is a strategic initiative by the Government of Malaysia to strengthen social protection for lower-income segments of the population.

-

Commencing on 1st September 2025, a RM30 voucher will be allocated to 2 million eligible Sumbangan Tunai Rahmah (STR) recipients.

-

This voucher may be utilised to purchase a new or renew a microinsurance or microtakaful product under Perlindungan Tenang framework offered by participating Insurers/ takaful operators.

-

Perlindungan Tenang products are designed to provide accessible and affordable financial protection, particularly for underserved and vulnerable communities.

-

For further details on available plans and participating insurers/takaful operators, please visit https://www.mycoverage.my/en/perlindungan_tenang3.0/.

-

The voucher will be allocated to 2 million eligible STR recipients on a first come first served basis.

-

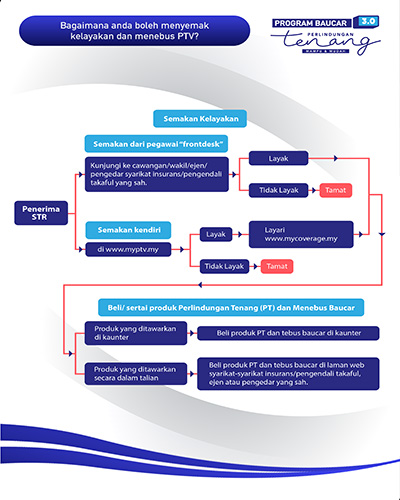

To check your eligibility, please follow the steps below:

-

Step 1: Go to www.myptv.my

-

Step 2: Key in your National Registration Identity Card (NRIC) number and tick (/) "YES, I HAVE READ AND UNDERSTOOD THE PRIVACY NOTICE" and "I'm not a robot."

-

Step 3: If you are eligible for the programme, the PTV system will generate a voucher number. Please use the voucher number when you want to redeem the RM30 voucher at point of purchase.

-

Alternatively, you may also walk into any branch or authorised agents/distributors of the participating insurers/takaful operators offering Perlindungan Tenang products under the PTV 3.0 Programme to check your eligibility.

-

There are two methods to redeem the voucher when purchasing your product:

-

Method 1 - Redeem the voucher and purchase online:

Step 1: Visit www.mycoverage.my

Step 2: Scroll down to the "Perlindungan Tenang Products under PTV 3.0 Programme" section. Click on each participating Perlindungan Tenang products insurers/takaful operators’ icon to understand the products' basic features and benefits. Please check the respective product criteria such as age limit and premium/contribution amount before deciding on the product that best meets your needs.

Step 3:Click "FIND OUT MORE" You will be directed to the respective participating insurers’/takaful operators' Perlindungan Tenang webpage.

Step 4:You will be guided through the simple process to purchase the Perlindungan Tenang product. You will need to fill in the information required such as name, National Registration Identity Card (NRIC) number, age, gender, and other required information to complete the purchase process. You will also need to key in your unique Perlindungan Tenang Voucher number to redeem the voucher during the product purchase. You are advised to read the terms and conditions of the product before making your purchase.

-

Method 2 - Redeem and purchase at the counter via Walk-In:

- You can also redeem the voucher and purchase the Perlindungan Tenang product directly at the branch office counters or authorised agents/distributors of the participating insurers/takaful operators.

- Understand the product's basic features and benefits, including checking the respective product criteria such as age limit and premium/contribution amount before deciding on the product that best meets your needs.

- If you choose to proceed with purchasing the product, you must provide the necessary information to complete the purchase process.

Please note that this process may differ from company to company. You are advised to consult the respective company's customer service representative for further details.

-

The PTV 3.0 Programme will be effective from 1 September 2025 until the voucher is fully redeemed or 31 December 2025, whichever is earlier.

-

Yes, you are eligible to claim the RM30 PTV in 2025, even if you previously claimed the RM50 PTV in 2021 and RM75 PTV in 2022, provided you are a STR recipient in 2025.

-

Life Insurance products

-

Takaful products

-

General Insurance products

PTV 3.0 voucher technical issue: ISM [03-22409899]

Email: ptv@liam.org.my

Phone: 03-26916628/6168/8068

Email: ptv@malaysiantakaful.com.my

Phone: 012-7720025

Email: pic@piam.org.my

Phone: 03-22747399

-

The list of products and participating insurers/takaful operators in this programme is available at https://www.mycoverage.my/perlindungan_tenang3.0/

Infographic

UNDERSTANDING

Life Insurance / Takaful Plans

Help protect you and your loved ones by understanding the types of Life Insurance ad Takaful. Choose the best plan according to your needs.

CALCULATOR

3 Easy Steps

Select your coverage

Choose the type of Life Insurance/Takaful based on your needs.

Insert details

Fill in your income, expenses, savings, and current coverage.

Calculate

We will give you an indication of your ideal coverage and protection gap.

CALCULATOR

3 Easy Steps

Select your coverage

Choose the type of Life Insurance/Takaful based on your needs.

Insert details

Fill in your income, expenses, savings, and current coverage.

Calculate

We will give you an indication of your ideal coverage and protection gap.